I believe in the power of internet marketing, web technology and efficiency. After a total disaster on the financial market and questionable investments in hyper-inflated priced properties, there is no other way forward than the technology sector with web services being in the lead of this trend. This sector is the need for very sensible and careful investors as technology changes all the time and without proper structure based backing we know what can happen…- and we do not like “bursting bubbles”. Opposite to speculations on financial markets which require almost no knowledge just good bluffing skills, and a quick reaction to exchange rates, political decisions and other news, the technology sector requires a firm knowledge base and “a magical ” business-tech-inventor nose to recognise and sniff out the good from the bad. This sector creates a division between the old and the new type of investors. In this light, it came to my surprise to see The Independent (my favourite UK newspaper) cover story from 21st May which looked like an invitation for speculators rather than knowledgeable investors to enter the web investment market.

Floating shares of social media giants give us a good reminder of what has happened in the past. Just after the first public shares of LinkedIn become available on NYSE making company worth U$10bn, The Independent asks questions regarding the true investment picture of this hi-tech social phenomenon. The picture The Independent painted for investors doesn’t look convincing. The newspaper brought to our attention Warren Buffett’s words which give potential investors an extra warning, but this all looks a little bit artificial as we are well into the third decade of www development. We know how much attention The Independent pays to its dramatic cover stories (don’t get me wrong – still my the most favourite paper in the UK), but this is an especially poor attempt as Warren Buffet doesn’t have a mobile phone and is not even using PC at work. By looking for the much younger successor from 2007, he admits he no longer understands investments in new technologies. His GE stock is perhaps the closest thing to Hi-Tech he owns and although his 2001 comments on dot-com bubble were valid most of the market analytics at the time spot what is happening well before he did. March 2011 comments about high values of social networks sites looked like his PR release rather than 100% analytic based opinion. He never personally attempted to invest in www start-up, and he is an “oracle” as far as he buys well established corporate shares where knowledge about speculations and over-investment are two major factors to manage success. In essence, Warren Buffet is the worst example of an investor to quote when talking about dot-com bubbles and bursts. He is the exact opposite of what makes up a www investor.

Warren Buffet Old Type Of Investor / Financial Market Speculator

After reading The Independent feature you would think the old world of “Brick and Mortar” and “Oil and Steel” investors is simply unable to digest the idea of products and services which are sold in quantities, millions per day and generate up to the sky profits without changing the Earth’s surface – too good to be true? No – it just requires modern thinking which is perhaps not in the heads of The Independent writers ;-).

The only worrying sign about social networks comes from the advertising profit vs value factor, which shows direct concerns for individual users rather than investors. The question is this: if they (Social Networks) don’t make money only from direct advertising, what happens behind the closed doors with our data? Anyway, the real value of these networks is a composition of two factors:

- How many users they have?

- How fast they respond to the current need of their community to engage people more and to avoid MySpace effect?

We are still to find out more about their commercial potentials.

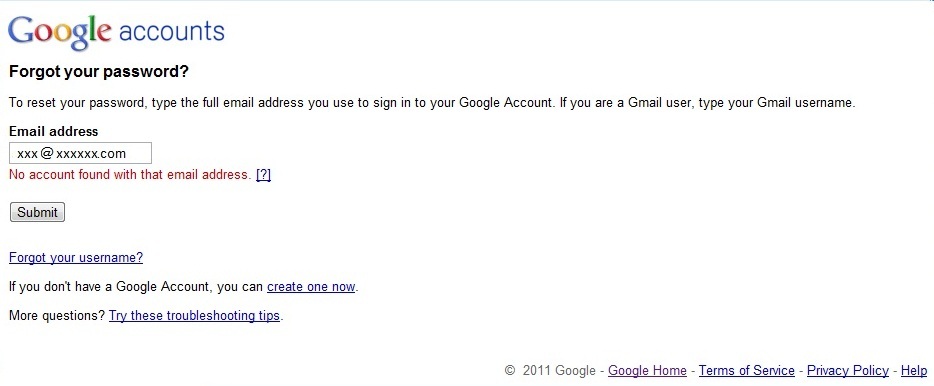

As many people say, Google’s real value is not yet discovered even by Google themselves. The gigantic set of data about our behaviour, gathered over the years, which Google is capable to store, but only use in a limited and a rather primitive way, creates perhaps the most precious part of this vast search engine.

Back to the point of investment in social media and www technology we created a list of 10 reasons why the dot-com bubble won’t burst again:

1) DSL services penetration - in 2000 speed and penetration of domestic broadband services was poor 150kbs was considered the internet speed of light only large organisations had access to T1 or equivalent connections. Half of the world didn’t know what the internet was and apart from the USA, EU, Japan, Korea, and few far east “tigers” use of the internet for domestic purposes was unknown. Today high-speed domestic internet connections are available on all continents including Antarctica and for some, Wikipedia becomes the main source of information, and replaced paper version of encyclopaedia in our houses. Speeds increase, networks expand to new territories and users.

You would be silly not to invest in growing market.

2) Control over data - the beginning of the century had seen Amazon struggling with a lawsuit when they used to serve different prices to different users. Amazon knew they should monetize from the knowledge they had about their customers’ behaviour somehow, but they had no clue how to do it. Nowadays, the sophistication of online direct marketing tools is higher. Online retailers, advertisers and publishers quickly learnt how to cooperate rather than compete with classic media channels to control their marketing effort and gather relevant information about the marketplace.

You would be silly not to invest in technology which gives you detailed information about your potential marketplace.

3) Mobile devices - once again, Apple showed the world the way forward. With three major players on the market, it became clear the war has just begun. The latest Motorola model shows a powerful phone which contains the ability to run your office on the big screen. With growing worldwide market penetration exceeding standard PC platforms, there is only one way for all of us – go mobile.

You would be silly not to invest in the most energetic and vibrant market in the world.

4) Efficiency - from a fascinating tool for academics and huge corporations and awkward gadget used in domestic environment exploited very well by porn and gaming industries in the early days of 21st century WWW become a stable and efficient day to day resource of information. Servers down seem to only appear on few websites (twitter in particular  ), and if this happens very often, it makes news in the offline media. Security standards improved. User numbers go up even though a lot of data about us has been stolen through the online environment (with the recent Sony PlayStation Network as a flagship example). These facts do not repel us from using the internet for the most vital operations in our lives (online banking, booking doctors appointments). Maybe, because of the other data leaks, we are no longer bothered? During the last few years, government agencies showed us that you do not need the internet to loose a 20 million records database with vital personal details. CD or USB stick is as much at risk in the hands of an incompetent public servant as the internet DB). Either way corporate and government institutions, as well as consumers, did their homework and it looks like a 5-minute visit to our online bank account is worth some risk (I wonder how many people remember how was it to queue in the bank for 45 minutes).

), and if this happens very often, it makes news in the offline media. Security standards improved. User numbers go up even though a lot of data about us has been stolen through the online environment (with the recent Sony PlayStation Network as a flagship example). These facts do not repel us from using the internet for the most vital operations in our lives (online banking, booking doctors appointments). Maybe, because of the other data leaks, we are no longer bothered? During the last few years, government agencies showed us that you do not need the internet to loose a 20 million records database with vital personal details. CD or USB stick is as much at risk in the hands of an incompetent public servant as the internet DB). Either way corporate and government institutions, as well as consumers, did their homework and it looks like a 5-minute visit to our online bank account is worth some risk (I wonder how many people remember how was it to queue in the bank for 45 minutes).

You would be silly to ignore the level of efficiency which is coming from these technologies.

5) Life dependency - mobile phones are now in their fourth decade of development. Recent polls have shown, a mobile phone is the most likely to be picked up from all our belongings, including clothes (people have worn clothes for thousands of years) if we are forced to leave home, and allowed to take just one item. Strange? – I don’t think so, but 20 years ago we would choose cash, pants or a long coat. The mobile phone is now recognised as the most sophisticated tool for survival. With smartphones on the offensive, it won’t be long we will use them for virtually everything. With cloud storage services, these will create a powerful combination. I assume there always will be people like Warren Buffet, who don’t use mobiles (he drags his PA behind him who makes all the calls :-)), but for most of us, mobile instead of a PA is the way forward.

You would be silly not to invest in services and products which are considered the most important “thing” currently in our lives.

6) World goes green – whether we like it or not. With all the energy consumption and heat created by servers during hours of continue processing www is a “green” technology in its roots. There is also genuine anti-corporate aspect and element of social media being powerful enough to help to shape political decisions (see Iran, Syria or Egypt uprising examples).

Investors would be silly not to make money on something people like, have monetization process established and can be used towards charitable causes like saving rainforest at this same time without being seen as an eco-extremist.

7) Capital generation – online capital buys online technologies. In the early 21st century money invested in dot-coms were generated offline. Investors knew very little about the technology behind these ventures. Currently, very high prices, are set on projects which attracted Google, Yahoo or Microsoft’s attention. These people made a lot of money online, and they know what to do with technology, unlike Rupert Murdoch, they know, what purchasing a social network is about; people and their needs. You won’t be able to do a lot if the only change you make is to introduce more advertising space. This is what happens when you have clueless people making decisions in a fast-paced technology environment. See YouTube.com and MySpace.com examples, and you will realize what is the difference between a social network that secured investment from the offline investors and online investors. As long online capital and online investors are involved in the online investment, we are safe from “bursts” and “bubbles”.

Investment is not for everyone! In 2000 you could convince people you have boo.com you want U$100m and they would give you money based on the assumption – others made money on the internet you will also be able to do it (of course you won’t). These days you need to prove to be interested first, and then your idea gives you the chance to attract investors.

8 ) Never ending process – Amazon, eBay, Yahoo!, Google, Facebook all reinvented (and invented) themselves during the last 15 years several times. They all give their users what is on demand. There is an ongoing process of data evaluation with the implementation. The closed process of the commercial product cycle is not present: the idea – development – product life – product redevelopment – product second life – new product. This is the case even for operating systems, and it has become standard in all software industries especially for social networks as they have to reply to live demand.

9) Information and content distribution channel (Internet reshaped our way of looking in to the world). The first sensible broadcasting TV Channel was available from the 1950s that means it took about 20 years of commercial TV use to make TV channels sustainable from an investors point of view and interesting for masses. After this initial period, we have had a colour TV, 24h channels, satellite TV and digital channels etc. Try to imagine, for about 6-7 years now www is in this stage where it becomes possible to invest huge money in it. But looking back into the development of TV technology we are yet to invent the equivalent of “colour”. Social networks are one of the many steps we have taken to create something we can call the semantic internet.

You would be silly not to invest in a new media channel which allows you to explore new markets and create new products and services.

10) We love it – despite addiction, efficiency and all these elements www and social networks give us this extra edge for communication and entertainment. They are important when we want to share a picture of a newborn with relatives overseas or communicate with a business partner on the go who is currently unavailable to chat face to face. YouTube, Twitter and Facebook were broadly adopted by masses, but also by their potential competitors – offline media. Newspapers, TV channels and radio stations all use and quote social media in their publications and programmes. Not being visible, not having followers means you are losing the audience. Some hate it, some love it but let’s face it with 500m users we are not talking about Marmite.

Investor who ignores investment in product as popular as can of Coke is silly. Ask Warren Buffet

These are all 10 reasons why there is no way that another .com bubble will burst. In the future if markets are down, they will be down with no specific relation to .coms the same way banks over-invest or property become useless from an investment point of view, we will see .coms evolving. There is no comparison with what is happening today, and what happened 10 years ago.

Investors simply need to adopt a 21st-century approach to investment, again if you think about the size of GE and the invention from which it started you can see the need for an open-minded approach to current web developments and inventions. Dotcoms are here to stay, and as per today, most of these businesses are well under-invested and extremely efficient. The ratio of the number of employees to the number of users is astonishing. Per head, each Google or Facebook employee earns much more for their company than an employee from traditional 20th century based corporations. The view that you can have small rented office 10 employees and make a lot of money makes no sense to 20th-century investment experts, who work with retail or heavy industry where millions stay behind the toolkit, properties and natural resources. This company structure makes an investment far from impressive from a speculation point of view. After all, what you’re investing in are just lines of code and some basic office infrastructure. With no knowledge, old fashion speculators are not happy with what they see.

BTW We have this great idea – Universalintergalacticsocialmodularmarketingnetwork.com to move it project forward we just need investment of $1bn USD .

Are you in?

————

Early Summer 2020 edit:

I decided to edit this article during 2020 Lockdown. The changes I made are only grammatical. I could not write back in 2011 as well as I can’t now :-), but now I can use sophisticated applications to make the text readable for you. The majority of what I said back then is still valid and it proved to be correct.

During the COVID-19 Pandemic, the web is the technology that rescues the trade and a broader economy and helps us to keep us safe. The web is now the channel that is used by billions of people to work and survive. eMeeting platforms, social media, eCommerce and more.

It was such an archaic article by the leading (at the time) newspaper. I must admit I’m no longer The Independent reader – the world is moving on.

Despite all the bad things happening, good things are happening too. It is also the web that enabled in the last weeks Black Lives Matter movement by showing endemic racism in public institutions designed to help. Similar to mentioned in the article, Arab Spring I’m excited to see people challenging the old world in the name of things that matter.

![]() if you fail this same people will be asked to pay from their taxes for your services anyway. Look no further than banks.

if you fail this same people will be asked to pay from their taxes for your services anyway. Look no further than banks.